- Drifft Newsletter

- Posts

- The Green Stone Age, how you gain from it, and special people you should know

The Green Stone Age, how you gain from it, and special people you should know

read in 5 min

Hey – David here. In this edition of DRIFFT you’ll get:

💡What’s New: Metals become even more critical in this Green Stone Age.

🤔 Opinion: How to gain from, or in spite of, today’s AI trend.

🛠️ Tools & Resources: speed your research and development.

🎓 Developer Spotlight: An influential developer you should know.

Want to feature your company in DRIFFT? Grab an ad spot here.

💡What’s new

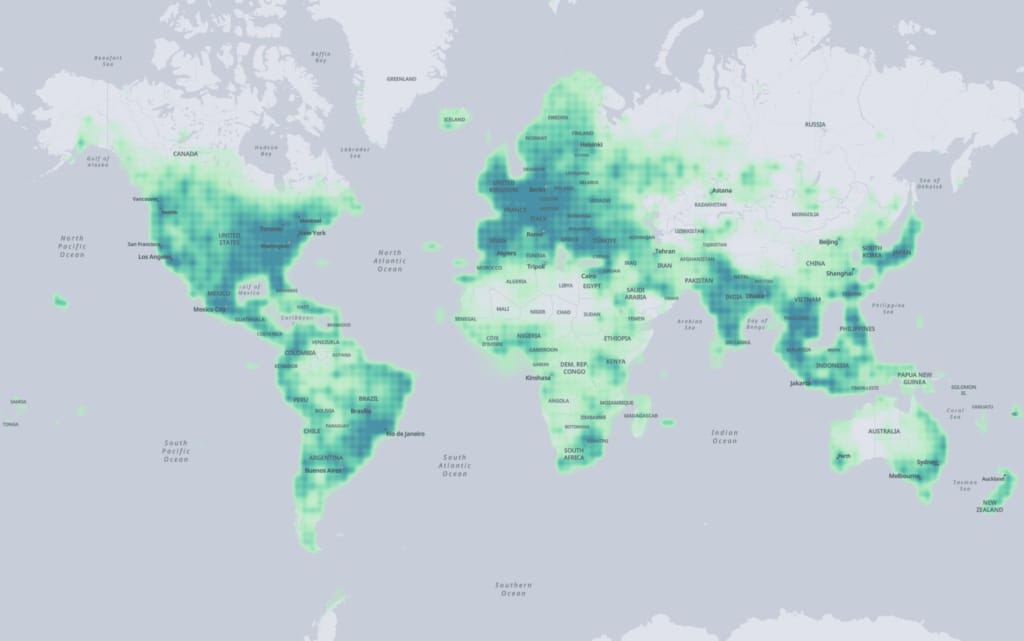

It’s clear from the latest research that we’re headed for a world where routine physical AND intellectual labor are automated. So it makes sense that claims on physical resources should rise in value. We’re living in a “green stone age” with clear evidence for it:

Venture capital in mining, while small, is growing…recently a $28M raise for mining tech.

While the US wields the dollar, China has minerals.

What does this mean for those of us interested in commodities? The future of these industries, and of all work for that matter, involves these 3 things:

More Metals - If LK-99 room temp superconductor is real, and it may be, we’re going to see even higher demand on metals.

More Data - sensing platforms (satellite, drone, etc) are on the rise with tech whales entering the satellite (drone, etc) data market.

More AI - intelligence, combined with robotics, will create explosive growth in smart machines. Robotics is one of the fastest growing jobs. Mining is transitioning from dozers to giant tweezers that pull rocks from the sea floor.

As these trends accelerate, more public data will be gathered from drill core sites. Maybe we’ll even see accurate ground mineral characterization as capabilities to model uncertainty reach superhuman levels.

🤔 Opinion

How can we, as individuals and companies, profit in commodities from today’s trends (or in spite of them)?

It’s unclear to me what short-term impact AI will have on mining company valuations. Understandably, there is still a lot of mistrust in new (i.e., unproven) technology. Most investors want certainty. Would you rather trust your capital to an AI-generated reserve report or to a drill core sample?

Overall, I’m speculating on volatility rather than any one technology. Trends shift market structure, which in turn boosts volatility, which then influences capital flows.

For those angling for value, here are some things worth considering:

Take a job / gig in mining. There is a noticeable lack of tech expertise in the mining industry where political / environmental sentiment can drive up wages. Overlooked areas are also less populated with talent. Do you want to be 1 in a crowd of 1000 or of 10? We’re playing odds, but we can also shape them.

Attend a conference like the upcoming Oct mining tech expo in Vancouver.

If you’re running a business, consider partnerships to pool data resources so you can leverage AI. Early access programs, like this one from Astraea, may also give an edge.

Look for knock-on effects in property and capital goods valuations, especially places known to have mineral reserves.

Get familiar with space-based monitoring systems to keep an eye on projects overseas, and to avoid financial train wrecks.

Learn (repeat). Things are looking up for those with solid software and robotics skills. Take courses on coursera or deeplearning.ai. I promise your career–and personal life–will improve. Read studies that synthesize learning from mining. Start experimenting with opensource and applying proprietary datasets to see what’s possible. You can start with this recent review of deep learning mining techniques. Also, get familiar with subsurface imaging techniques.

🛠️Tools and Data

Resources to power your R&D.

NASA onboard AI platform for testing interactions with cFS flight systems. |  |

5B Pixel Dataset: https://x-ytong.github.io/project/Five-Billion-Pixels.html Free high-res land classification dataset using satellite imagery. |  |

Open Building Dataset: https://sites.research.google/open-buildings/ Google’s open dataset for building footprints. |  |

OSM GPT: https://github.com/rowheat02/osm-gpt Query open street map with GPT. |

🎓 Developer Spotlight

Leading influencers developing opensource earth systems.

When you think of satellite radar imaging and complex modeling, Alexey should be top of your list. He is singlehandedly building the PyGMTSAR framework to give satellite interferometry to everyone. |  |

His latest book shows how to find hidden underground aquifers and even monitor centimeter length shifts in the ground for free using government satellites. All from a computer as small as a MacBook Air.

Imagine being able to invest in a mine and then easily monitor progress above and below the earth. Talk about an information edge. Thank you, Alexey!

Share DRIFFT

Know someone looking to level-up their AI and opensource game in mining? Just copy and paste this link: https://drifft.beehiiv.com

Thanks for reading! Want me to look into a particular topic? Email your suggestions and and I will dig.